You Gotta Know When To Fold ‘Em

Kenny Rogers said it best: The most crucial piece of information in investing is knowing when to cash out of a market.

All U.S. asset classes are currently overinflated.

The bond market just sent us a dire warning about the future of the U.S. economy.

All the economic indicators are flashing red.

One of these warning alarms is accurate over 90% of the time…

Knowing what these alarms are warning of could ensure you don’t take a financial hit like you did in 2008.

By acting now, you can insulate yourself from this impending crisis.

What’s better, you’ll have not one but two opportunities to turn this impending crisis into cash profits.

It’s not a question of “if” or “maybe.” A recession is on the way.

Economic models are famous for their vagueness, but the IYC model has a proven track record of more than 90% accuracy.

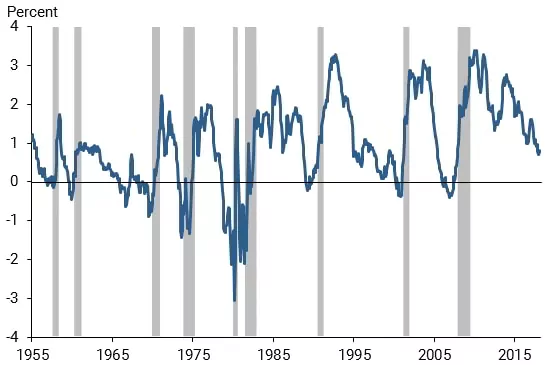

This economic model predicts the medium-term likelihood of a recession, and it has predicted every recession since 1955.

There has never been a more accurate system.

The Inverted Yield Curve (IYC)

This complicated-sounding economic model is astoundingly simple.

What it predicts is miraculous.

It works by examining the relationship between the yields of short-term (2-year) and long-term (10-year) U.S. treasury bonds.

A bond’s yield is another word for the interest rate a bond pays you.

Rudebusch and Williams, researchers from the San Francisco Federal Reserve Bank, affirmed in 2009 that the IYC model “reliably predicts low future output growth and indicates a high probability of recession.”

Usually, long-term bonds offer higher yields than short-term bonds.

This is because there is more risk in tying your money up for the long term than the short term.

If someone is taking on more risk, they want more reward. It’s that simple.

With an inverted yield curve, the short-term bond yields are higher than the long-term bond yields.

This means that bond investors believe that the economy is riskier in the short term than in the long term.

Markets run on sentiment, which is another word for belief.

With an IYC, the market makers believe that a recession is coming.

When bond investors think a recession is coming, they buy long-term bonds, with a view to riding out the recession by locking in interest rates today before a recession reduces yields.

Due to the law of supply and demand, this increased demand for long-term bonds drives down the return offered by those bonds.

This creates the yield inversion, where short-term bonds offer higher yields than long-term bonds.

Because the market makers believe a recession is coming, a recession manifests.

It’s a self-fulfilling prophecy that has almost never been wrong.

Effects Of The Inverted Yield Curve

1. Recession

An IYC is the most accurate long-term predicter of a recession in the financial analyst’s toolbox. It comes with a 90%+ accuracy rate.

2. The stock market falls

When a recession begins, the stock market sees the effects first. This means stock prices fall, pensions lose value, and portfolios are wiped out.

3. Increased mortgage rates

The knock-on effect of IYCs is increasing interest rates on mortgages.

4. Increased defaults

With increasing mortgage interest rates and the creeping effects of a recession, mortgage defaults increase rapidly.

5. House price depreciation

As homeowners default due to recession, lost jobs, and increasing interest rates, the property market stalls and then falls into its own recession. This drives down prices in the property market.

When Will This Inverted Yield Curve Happen?

It has already begun.

On Thursday, March 31, the yield on 10-year U.S. Treasury bonds was 2.331%, six basis points below the two-year U.S. Treasury yield of 2.337%.

We have yield curve inversion for the first time in years… which means a recession is looming.

How Accurate Is The Yield Curve Model?

Since 1955, the IYC model has predicted every one of the last 10 recessions. It has only predicted one recession that didn’t happen.

The one recession that the IYC predicted in the 1960s that didn’t become a full-blown recession did in fact turn out to be a big economic slowdown.

With its proven accuracy, the IYC model begs us to remember hedge fund pioneer Sir John Templeton’s famous words, “The four most dangerous words in investing are, ‘it’s different this time.'”

It’s not going to be different this time. A recession is coming.

It’s time to take action…

How Long Until The Recession Hits Us?

Look at the gray lines on the yield curve graph above. These are recessions.

In 90%+ of instances when the yield curve inverted, within 6 to 24 months the economy was in recession.

In economic forecasting, an accurate 6- to 24-month predicter of a recession is like having powers of prophesy.

How Can You Take Advantage Of This Inverted Yield Curve?

All U.S. asset classes are overinflated.

It’s time to cash out of the U.S. markets while prices are buoyant and stash your investment money somewhere that is insulated from the coming U.S. recession, where it can earn you good profits in the meantime.

Overinflated Asset #1: Housing Bubble

The United States is in the grips of a housing bubble. Bank of America reported that average prices increased 18.8% from December 2020 to December 2021.

This bubble was caused by historically low interest rates and a buying frenzy brought on by the pandemic.

Millions of investors have seen huge on-paper profits because their real estate investments have appreciated in value.

If you ride the housing bubble until it bursts, you will lose all the equity you have gained and might even lose the property to foreclosure.

Interest Rate Spikes

The base mortgage rates in the United States jumped from 3.75% to over 4.5% in February 2022—a 20% jump. This will undoubtedly cause the first round of defaults in the property market.

How Can You Take Advantage Of This U.S. Property Bubble?

It’s time to fold your cards and cash out of the U.S. property market while prices are sky high.

Now is the time to put your profits somewhere they can earn safe double-digit returns for a few years.

When the coming U.S. recession is at its worst, you can swoop back in and buy real estate for pennies on the dollar if you want to.

Investors who got out of the housing market before the 2008 crash made billions after the crash by buying distressed homes for a fraction of what they cost just two years previously.

Some people I know even bought back the exact properties they sold during the boom for a 70% discount. They got their house back plus an extra 70% cash in their pocket.

Overinflated Asset #2: Stock Market Overheating

The U.S. stock exchanges continue to break new highs.

See the graph of the Dow Jones above: It has more than quadrupled in value over the past 13 years.

The reason the bond yield curve is inverting is that the large investors know this bubble cannot continue for much longer.

This is why institutional investors are buying long-term U.S. Treasury bonds, and this is driving the yields down.

The market makers know what’s coming, and they are hedging their bets.

What Can You Do About This Impending Stock Market Crash?

It’s time to cash out of the stock market while the going is good and move your investments into an asset class that’s solid and insulated from the coming U.S. market crash.

Overinflated Asset #3: Peak Gold

Gold has boomed to over US$2,000 per ounce.

The spot rate for gold is 1% below the highest rate it has ever reached.

While people always believe in gold, the gold hounds don’t predict gold going much higher at the moment, without a fundamental shift in the basis of our entire economy.

Gold is a good long-term store of value, but buying gold at the top of its highest ever market isn’t.

If you own gold, now is the time to liquidate it and invest in assets that have the potential to produce profits for you in the medium term.

You can always buy more gold when its price dips back down below US$1,400.

Overinflated Asset #4: Crypto Is Unstable

Cryptocurrencies are our modern-day tulip mania, reminiscent of the 17th century bubble in tulip values in Holland, when some single flower bulbs cost more than six times the average annual salary.

Billionaires are made and lost in cryptocurrencies every week, and even those who make billions from them probably don’t know how cryptos actually work.

If you have been lucky enough to make crypto profits over the past few years, it’s the perfect time to cash some of these profits out and get them into tangible, income-producing assets that work for you.

Inflation Is At An All-Time High

The United States posted a 7% inflation rate this year. This means any cash you kept in your bank account lost 7% in value.

Avoid this loss in 2022 by putting that money to work for you outside the U.S. economy.

There Will Be A Crash

The inverted yield curve pretty much guarantees this impending recession.

The frothing stock market is a strong sign of overvalue and is an indicator of a stock market correction soon.

The property market saw 18% capital appreciation last year, but rising interest rates and creaking stock market returns will likely ensure modest growth this year and a housing recession next year.

Gold offers no value, and cryptocurrencies are a total crap shoot.

The solution is obvious…

Cash Out And Buy Medium-Term Foreign Assets With Strong Yields

Take your winnings and step out of the U.S. markets while they correct themselves by investing in solid yielding foreign assets, and reinvest when the U.S. markets bottom out in the recession.

This allows you to:

- Realize your U.S. profits before the recession gobbles them up,

- Seek out more stable and higher-yielding investments abroad,

- Buy back into the U.S. market for pennies on the dollar in two to three years.

This strategy allows double or even triple dipping of profits.

The Opportunity

This ideal medium-term investment for someone who wants to cash out of the U.S. markets now is one of my personal favorites.

It offers you a developer-guaranteed 30% profit after two years. This two-year investment is the ideal amount of time needed to wait out the U.S. recession. If the recession lasts longer, you can reinvest your profits for another round.

The investment is insulated from the U.S. stock market, U.S. bond market, and the U.S. property market.

The investment is in a diversified and rapidly growing economy, and the deal is designed to capitalize on a US$1 billion government fund.

Go here to find out more about this recession-busting, profit-generating, and risk-diversifying opportunity.

Con Murphy

Editor, Overseas Property Alert