Recession Planning: Cash Flow Vs. Capital Appreciation

We are living in interesting times.

Inflation reached a 40-year high in June, the U.S. life expectancy has dropped by almost 3 years, and the economy is teetering on the precipice.

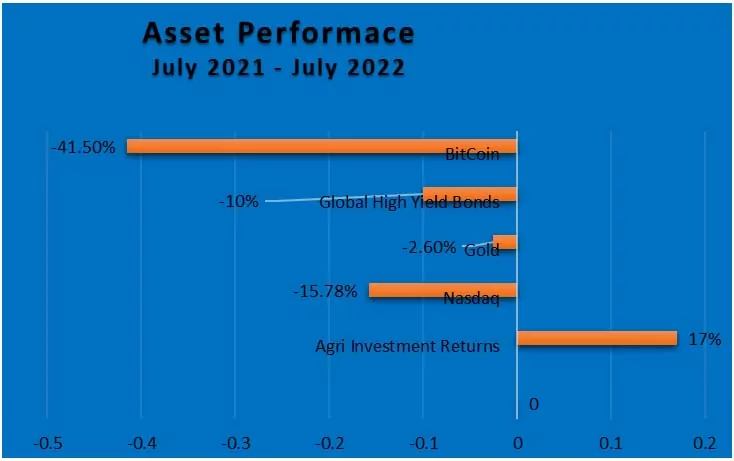

The NASDAQ index has fallen 27% in value and Morgan Stanley predicts stocks will fall another 23% this year alone.

When the stock market crashes, almost all stocks will lose value. Yes, some will crater while others just dip, but it’s hard to know which ones to pick.

In a recession, blue chip value stocks that produce vital products can hold their own and a few might even gain some ground, but your dividends often don’t keep up with inflation.

I’m not here to be gloomy… I’ll let you in on a simple solution.

You need to get out of stocks and into alternative high-earning investments, at least until the recession is over. Set your sights on tangible assets that you own in your own name in recession-proof industries with major market or competitive advantages.

You’ll see that my choices aren’t in traditional investments like stocks, crypto, bonds, or securities.

I prefer investments that are outside the box in times of turmoil. If you follow the crowd in times of recession you will end up where everyone else will… broke.

These two basic investment types can increase your financial stability even during a recession:

- Cash flow investments.

- Long-term capital appreciation projects.

There are pros and cons to each, but one thing these investments have in common is that they aren’t stocks. It’s foolhardy to try and hedge against a systemic correction in the stock market by buying more stocks.

Which one is better to protect yourself against recession, cash flow or capital appreciation investments?

The answer lies with you, the investor.

Cash flow investments give you the flexibility to enjoy your profits during the investment period or to diversify your investment portfolio by reinvesting the cash flow into other ventures.

The drawbacks of cash flow investments are the extra tax reporting to your home country and possible depreciation of buildings or equipment.

Long-term capital appreciation investments have pros and cons, too. The major advantage is that they are a set-it-and-forget-it type of investment. You invest once and expect that years or decades from now you will be able harvest a bumper capital return on your investment.

Many of my friends are long-term land speculators. They buy tracts of agricultural or old industrial land and sit on it for years hoping that town expansions or zoning changes will make it valuable.

Sometimes they win big and other times it’s a bust. That’s not what I consider a good long-term capital appreciation investment. It’s more like gambling.

What I call a good long-term capital appreciation investment is a deal that requires only a small investment up front with few to no carrying costs. When you are facing a recession, good-quality, low-price investments make diversifying your portfolio easier. Your asset must be guaranteed to be valuable at the end of the long investment period.

Capital appreciation plays can be great intergenerational wealth gifts to your heirs or grandkids. Both investment types are suitable for tax-efficient growth by owning them through your IRA or 401k.

These are two of the best recession-hedging investments out there; one is cash flow focused and the other is long-term capital appreciation focused.

Cash Flow Investment: Food Production

Food production is the epitome of recession-proof, as people have to eat no matter the economy. Continuing global food shortages due to drought, spiraling energy costs, and the war in Ukraine will continue to increase food prices.

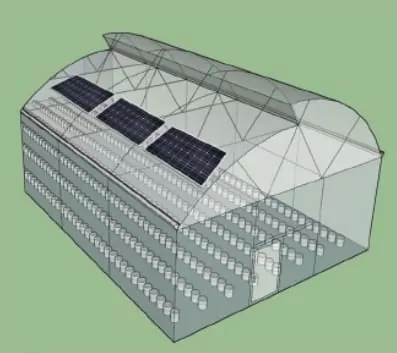

The lucrative solution is investing directly in high-tech hydroponic greenhouses.

This investment offers the opportunity to create recession-proof cash flow while tackling a major global problem.

In many parts of the world, you would be lucky to get one or two harvests per year using conventional field methods. These specially selected hybrid varieties grow so fast in these high-tech greenhouses that you can get nine harvests per year.

The developer has already established successful hydroponic greenhouses that have sold out harvests and paid out returns to earlier investors.

The competitive advantage here is in their eight years of R&D and in being a technical leader in hydroponic production in Asia, which is a huge market.

Contracts are in place with some of the largest distributors in Thailand. A new government-approved packing facility is almost complete, so they’ll soon have access to the insatiable export markets in Hong Kong, Singapore, Malaysia, and the Middle East.

Each greenhouse is solar powered to improve sustainability, reduce operating costs, and remove the risk of crop losses due to power failures.

You own the greenhouse and the team on the ground plants, farms, harvests, and sells the Japanese cucumbers for you. A 100% turn-key investment.

Many agricultural investments like fruit trees take years or decades to reach full production. This deal starts paying out at the full production rate in year 2.

You can expect more than US$8,000 per year and your greenhouse should last longer than the 20 years financial projections cover.

These are the terms and features of this project:

- The purchase price is US$37,950…

- You could earn a potential 423% net ROI and internal rate of return (IRR) of 17%…

- Your total payout (20 years of accumulated net returns) could be US$160,654…

- This investment is fully insulated from the stock exchange…

- It’s close to the world’s biggest and fastest-growing food market…

- You get annual payments after year 2…

- The management team has a proven track record…

- It’s ethical and sustainable…

- The developer offers flexible exit strategies…

- The investment term is 20 years.

If this sustainable, cash flow-producing investment with turn-key high returns is of interest to you, click here to find out more.

Capital Appreciation Investment: Hardwoods

My favorite long-term capital appreciation investment is in hardwoods.

If you plant them where conditions are ideal, the trees mature in 25 years with practically no inputs or maintenance required. An investment in well-managed hardwoods can give you consistent long-term capital appreciation.

It’s a legacy you can pass on to your children or grandchildren. My favorite is in the most prized and versatile commercially grown lumber in the world.

Teak plantations.

It’s in high demand for high-end home finishes, furniture, and boats because it’s beautiful, extremely durable, and is water, fire, rot, and pest resistant.

This investment is in your own titled land with teak trees already planted. It will be sustainably managed and replanted after each harvest for a nominal fee. This could be a legacy investment for generations.

Teak investments feature several other benefits… the entry price point is low, it’s a turn-key investment, it’s not linked to the stock exchange, it’s good for the environment, you’re handed your own titled land, and it could lead to residency if you invest the minimum required amount.

Panama is the perfect country for premium sustainable teak plantations.

These plantations are found in elevations, soils, and climates suited for teak.

The teak parcels are fully managed by experienced teams. The maintenance cost of a titled teak parcel is just US$125 per year, and this covers management, maintenance, and thinning your trees.

At the end of the 25-year investment, the replanting costs for your parcel will be only US$300, ensuring your investment can continue to provide capital appreciation for your heirs for generations to come.

If you’re looking to get residency, the Panamanian Forestry Investor’s Visa offers a temporary two-year visa in exchange for a US$100,000 investment. After this period, you can apply for permanent residency.

This is just a fraction of the US$500,000 investment that will soon be required for the Investor’s Visa in Panama.

Other features and terms of this deal:

- The minimum investment amount is US$6,880, plus US$1,024 in titling fees…

- You get a final payout of US$94,020…

- Your parcel size is 1/4 of an acre…

- The parcel will have newly transplanted saplings…

- You’ll own fully titled land…

- Financing is available if you buy more than two parcels…

- You are positioned to earn a net ROI of 1,267%…

- This investment leads to a second passport if desired…

- The investment is tax exempt by the Panamanian government.

If you’re looking to receive your payout much sooner, similar-sized parcels of 16-year-old trees are available for US$18,866.

If you want to find out more about this teak offer and its possible residency benefits, click here for more information.

Con Murphy

Editor, Overseas Property Alert