Goldman Sachs Calls This The “New Oil Industry” For The 21st Century…

Goldman Sachs calls it the “new oil industry” for the 21st century.

And shortages of this resource will “result in state failure,” according to the CIA.

This coming crisis isn’t about a lack of oil, food, or medicine.

The issue is more fundamental.

It’s about fresh water scarcity.

Global Fresh Water Supplies

Today, many countries are net importers of fresh water and water-based products like foods that take vast amounts of water to grow and produce—meat, nuts, and dairy products, for instance.

For example, 1 kilogram of beef takes about 15,000 liters of fresh water to produce.

Water-poor countries are importing food and buying water from water-rich countries, receiving it through pipes and tankers.

Places like North Africa, the Middle East, Mexico, Japan, and most of Europe are experiencing extreme water shortages right now.

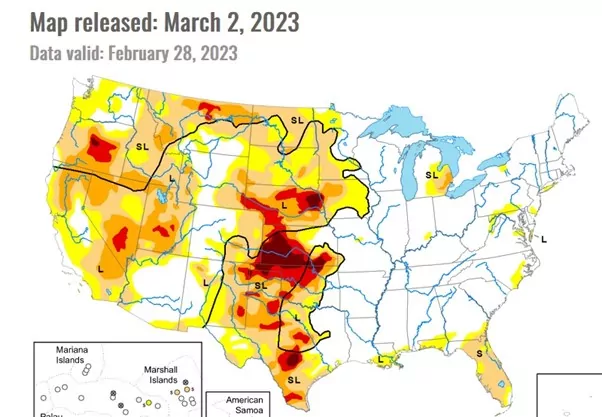

Much of the western and southern United States are currently in extreme drought situations. See the U.S. drought map released this month…

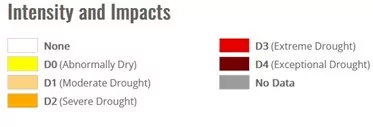

The list of places with extreme water shortages is set to grow to include all of China, India, and the United States by 2040.

The World Resource Institute predicts that most countries around the world will no longer have access to adequate fresh water supplies by 2050.

This will pose a risk to both national and global food markets and change the way the world feeds itself forever.

Added to this is the global security issue that pumping groundwater supplies dry creates…

The UN predicts that, unless this water crisis is mitigated, it could displace 700 million refugees by 2030.

At the end of 2021, there were 27 million refugees recognized by the UN globally. The EU welcomes only about 10% of these people, but the economic and cultural impacts have toppled governments.

Imagine what will happen if 25 times more refugees are displaced…

Former UN Secretary General Boutros Boutros-Ghali accurately predicted in the 1990s that the next war in the Middle East would be fought over water, not politics.

Since then, we’ve seen disputes and conflicts in the Euphrates and Tigris Rivers among Turkey, Syria, and Iraq, and between Israel, Lebanon, Jordan, and the State of Palestine over what’s called the Jordan River conflict. The Nile River has seen conflicts among Egypt, Ethiopia, and Sudan.

But not all countries will be without water.

Water Is Going To Be The Next Global Oil Rush

The CIA reports that, like the oil empires of the 20th century, there will be water empires in the 21st century.

Three countries control the lion’s share of the global water reserves. They will form the basis of the future freshwater equivalent of OPEC, which controls global oil supplies today.

The situation in the United States and Eurasia looks desperate.

But the billionaires are already getting richer from this crisis.

Business magnate T. Boone Pickens bought up hundreds of thousands of U.S. acres with freshwater rights in the 1990s with profits he made by selling oil wells. In 2011, he sold the water rights for US$103 million.

Michael Burry, financial seer of “The Big Short” fame, is investing heavily in land with water rights, too.

The Problem With Water

Some 97.5% of all the water on the planet is undrinkable salt water, which takes an extraordinary amount of energy to desalinate.

Only 0.3% of the freshwater on Earth is in surface lakes and rivers. The rest is locked in glaciers or in shallow groundwater aquifers and in “fossil water” deposits in aquifers deep underground.

The shallow aquifer water is semi-renewable and accessible via shallow well digging. However, deep fossil aquifers are considered non-renewable because they’re pumped dry in the space of decades and take millennia to replenish.

Today, much of the water used globally comes from pumping fossil aquifers. When they run dry, the countries reliant on them will become chaotic.

Studies show that even the most efficient desalination plants, like the ones used in Saudi Arabia and Israel, still cost twice as much to supply water when compared to buying fresh water from water-rich countries using pipelines or ocean tankers.

Exhaustion of groundwater sources will cause global food production to decline during the same time period that the global population is expected to go from 7 billion to 10.5 billion.

Possible Solutions

In “Meteorology,” Aristotle devised the first recorded scientific solution to this issue.

He observed the process of distilling freshwater from saltwater and suggested a rudimentary form of reverse osmosis using a wax membrane.

Yet over 2 millennia later, scientists are still working to find a way to economically desalinate water on a large scale.

And, even if successful, their efforts may be too little, too late…

Agriculture accounts for 70% of the freshwater used by humanity. Modern irrigation technology will reduce our usage, but as water-poor countries pump their ground water aquifers dry, their ability to grow enough food to sustain themselves, even with more efficient irrigation technology, will continue to fail.

Massive desalination plants like the Ras Al-Khair plant in Saudi Arabia can provide water to millions every day, but these cost billions to construct and are energy hungry.

Currently, the only viable option is to transport water via pipelines from water-rich areas to water-starved areas.

Beijing relies mostly on ground water, pumping aquifers deep underground… but as that option runs out, it’s building a 1,000-kilometer pipe from the Quan River at a cost of US$80 billion.

If you’re interested in sustainable, water-efficient, food-producing investments, take a look here to find out more about my favorite option.

Who Are The Winners In This Scenario?

The countries with the largest renewable water reserves are:

- Brazil: 8,233 cubic kilometers

- Russia: 4,507 cubic kilometers

- Canada: 2,902 cubic kilometers

To give you an idea of how much water this is, the entire world pumps about 800 cubic kilometers of groundwater per year.

The CIA estimates that Brazil, Russia, and Canada have more renewable freshwater resources than all of Europe, Australia, Africa, the United States, China, and India combined.

These three countries will control the global water market by 2050.

When any small group of countries have a virtual monopoly on a resource vital to global survival, I recommend investing in them, however…

Canada has recently banned all foreigners from buying property there in an effort to prevent its already massively overinflated property bubble from worsening.

Russia, with its habit of nationalizing foreign-owned property, dreadful human rights record, and propensity for throwing oligarchs and businessmen out of hotel windows, probably won’t be a place where Westerners can safely invest for the next 50 years, if ever.

Brazil is another story…

It controls an incredible 20% of global renewable freshwater reserves.

It also has undervalued real estate, is friendly to foreign investors, and has a huge and diversified economy that bodes well for short- and medium-term economic growth, even before it becomes the world’s first water empire.

The Opportunity In Brazil

This brand-new opportunity is just steps from a pristine, soft sandy beaches and five minutes from the town of Canoa Quebrada in the Northeast Region.

It’s also a short drive from the hotels, shops, health center, outdoor markets, and colonial architecture of Aracati.

Known for its long stretches of pristine, sun-drenched, sandy beach and ideal year-round warm weather, Canoa Quebrada is one of Ceara´ State’s most popular tourist destinations.

Folks flock here to enjoy a range of fun outdoor activities… kite surfing, boating, dune buggy rides, and more…

In the next town over, you’ll find one of the largest waterparks in Latin America.

This is your chance to get in early on an undervalued market in a strong tourism rental area.

Right now, the path of progress is driving straight down from Fortaleza city to this development.

The area is home to several of Brazil’s most beautiful beaches… and these bungalows, specifically designed to target the growing domestic and international vacation rental demand, are just steps from the ocean.

You can use this investment property yourself or rent it out through the professional in-house property rental and management company.

The projected net ROI is a healthy 10%.

The developer has successfully delivered 3,000 homes in Brazil, showing their ability to fulfil their obligations in this emerging market.

The Details

| Investment Property | Beachfront bungalows |

| Location | Canoa Quebrada (90 minutes from Fortaleza, capital of Ceara´ State) |

| Discounted Cash Price | US$77,000 |

| Financed Price | US$89,000 |

| Specifications | One-bedroom, one-bathroom |

| Options | Private pool |

| House Size | 57 square meters |

| Lot Size | 320 square meters |

| Rental | Full-service property rental and management available |

| Completion | Mid-2024 |

Developer financing is available at 25% down with the balance financed over 24 months.

The developer has released 10 units of the same size and price for Phase I of this project, so I advise you to move fast if you want to secure a unit at this fantastic price point.

The optional furniture package is priced at US$10k; you can pay this at completion if you wish.

Find out more, or secure one of the few remaining units in this first phase of the development, by going here.