Jumping Back Into The Market In Panama City

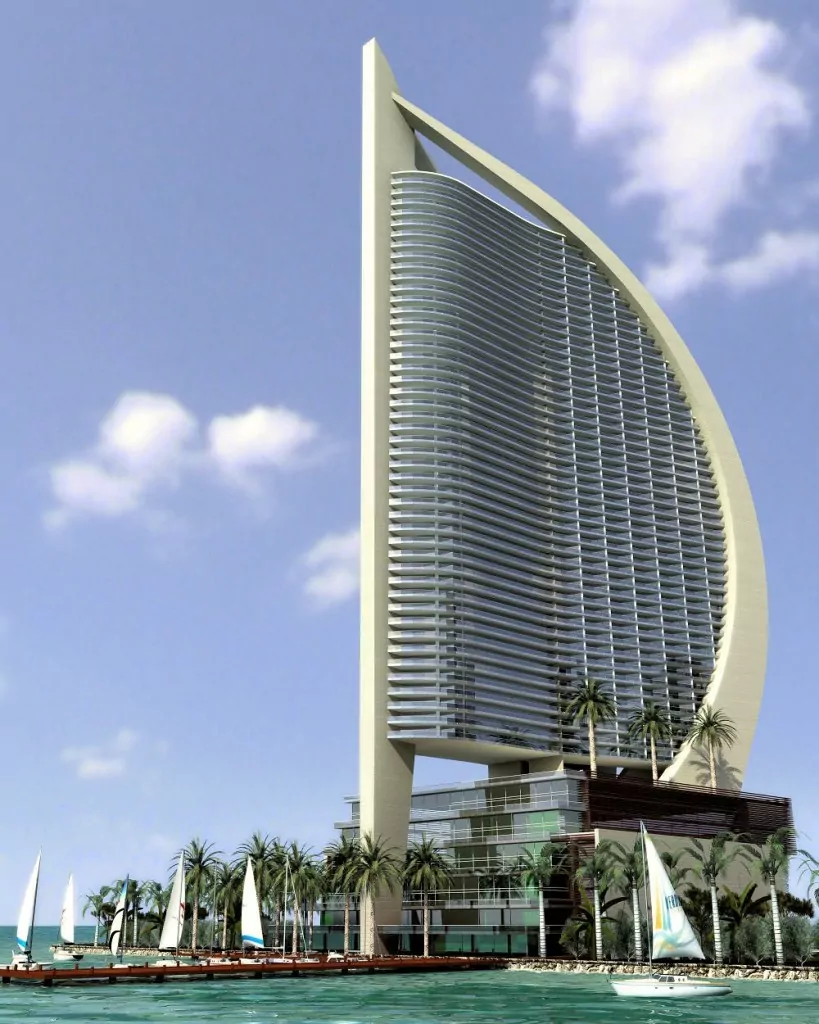

Jan. 13, 2015 Santiago, Chile Panama uses the U.S. dollar Dear Overseas Property Alert Reader, Panama City was a miracle property market for many years. People who bought condos in those gleaming waterfront towers back in 2002 saw the values of their properties skyrocket over the next six years. Many income investors saw solid, double-digit […]

Jumping Back Into The Market In Panama City Read More »