Escaping The Mortgage Meltdown

The age of cheap credit is over… The mortgage market will never be the same.

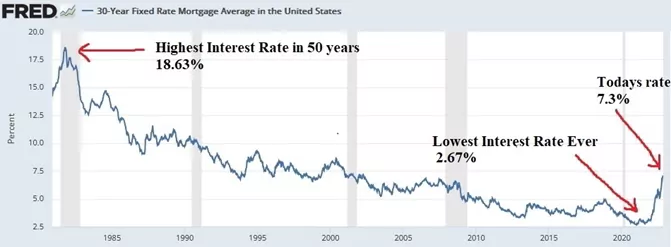

Six months ago the mortgage rate was 2.6%. Today it’s 7.3%.

Think interest rates couldn’t go any higher? Think again…

Just over 40 years ago the mortgage rate was a crippling 18.6%, and with inflation at a 40-year high right now, there’s no reason that interest rates couldn’t return to a 40-year high, too.

To understand why interest rates are running rampant again, we need to look at what drives them.

Money Supply

The Fed has created money at a mindboggling rate over the past 14 years. They used the trillions in extra cash to buy up freshly imagined financial instruments (bonds) to boost the economy.

We sacrificed the dollar on the altar of quantitative easing (QE) to avoid some financial hardships post 2008, but it kicked the can of economic pain down the road.

As all economists know, excess money supply causes inflation.

Inflation

To curb inflation caused by its QE bonanza, the Fed started raising interest rates in early 2022 in the outdated belief that increasing the interest rate cures all inflation.

What they didn’t account for was that the inflation was also caused by corporate profiteering.

In an unusually successful effort at self-harm, the Fed raised the interest rates, which sucked the money out of the bond market, which in turn undermined the value of all the bonds that the Fed had created.

This caused a huge hole in the Fed’s balance sheet, which concerns U.S. creditors.

Government Borrowing

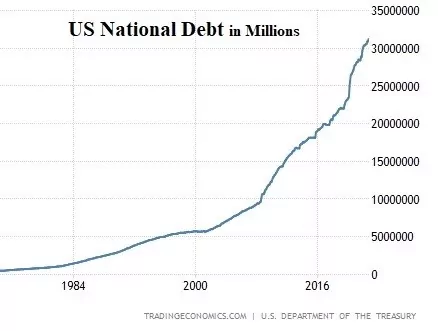

In 1977, the national debt was US$669 billion. Today, the U.S. national debt is about to top US$32 trillion, 48 times greater.

In the chart below, it’s easy to see that the debt didn’t occur at an even pace. It rose slowly until the late 1970s, sped up a little during the 80s and 90s, but skyrocketed after 2008.

Government Policy

When consumers and banks don’t trust the government, they don’t spend or lend money. This makes money supply scarcer and puts additional upward pressure on interest rates.

No matter if you vote red or blue, you must agree that the economic and fiscal policies implemented recently haven’t built confidence in the system as a whole. The Fed seems intent on continuing to take careful aim at its own foot.

Today, we’re in unknown fiscal territory. No one seems able to agree on how to stop the economy floundering.

Skyrocketing interest rates won’t affect you immediately if you currently have a fixed-rate mortgage and don’t need to refinance in the next five years…

However, as interest rates increase, so do mortgage default rates, which causes house prices to collapse and drives down the value of your home.

If you get into negative equity, you could find yourself stuck with an asset that you can’t get out from under, an asset that could ruin your retirement plans.

Anyone with a floating interest rate mortgage or looking to invest in U.S. property or remortgage in the medium term needs to be careful. An increase of a few percentage points doesn’t seem like much, but over the life of a mortgage, it’s huge.

The Average New Mortgage

The Federal Reserve Bank of Saint Louis tells us that in 2022 the median price for a new home in the United States is US$440,000.

Assuming you have good credit, you could get a 90% loan on the property. This leaves you with a US$396,000 mortgage.

Last year this mortgage would have been offered at 2.6% over 30 years and cost you US$1,590 per month in mortgage payments. You’d pay US$174,720 in interest over the life of the loan.

Today, you’d pay US$2,700 for the same mortgage (US$1,110 more per month), and you’d repay US$581,000 in interest (that’s US$406,000 more in interest).

If the interest rates shoot up to the 1980s peak, you would be paying US$6,160 per month (US$4,570 more per month) and would end up paying US$1,822,000 in interest over the life of the loan.

This is the power of compound interest when it’s used against you… and it could be an unmitigated disaster if you’re not prepared.

What’s The Solution?

Savvy Americans are selling their U.S. stock and real estate investments and buying property overseas for a fraction of the cost of the house they currently live in.

In some cases, they’re renting cheap homes overseas and drinking piña coladas on the beach while they ride out the coming recession. When the recession eventually ends, they’ll buy back into the U.S. market at much lower prices.

There are many places overseas where you can live like royalty for less than the average cost of a new mortgage in the States today… Yet some people still see going overseas as too drastic.

Is it as drastic as losing 35% of the equity in your house and having to pay tens of thousands of extra dollars per year just to keep your house from foreclosure?

Who knows how long interest rates will be this high…

Remember, interest rates won’t return to normal until inflation is brought back under control. With the current U.S. government spending spree, it’s not likely that inflation is going to drop back to 2% any time soon.

Where on Earth can you live on US$2,700 or less per year and find a cheap but nice property to live in while you ride out the U.S. mortgage meltdown? In more places than you might think.

The U.S. dollar hasn’t been this powerful in decades. The world is your oyster. Get out now, ahead of the pack, and jump start your luxury retirement for less.

Ceará, Brazil

Brazil is my #1 investment location to ride out a recession. Its economic fundamentals are great, and its political problems are over for now.

A growing expat community speaks to its appeal… and the cost of living is an undeniable bargain. Here you can live on US$690 per month if you own your home and US$1,050 if you rent… A fraction of the cost of a new mortgage in the States, plus rental returns are far higher in Brazil.

I’ve identified a unique investment opportunity along Ceará’s coastline… It’s a one-hour drive from Fortaleza, the country’s fifth-largest city and home to an international airport.

The development is situated on a peninsula with stunning white-sand beaches on each side, and its turn-key beachfront homes are ideally suited to capitalize on the growing short-term tourism rental market.

All homes in the development come with a pool, outdoor terrace, and air conditioning. The development is close to amenities like a supermarket, pharmacy, and hospital, plus several restaurants, beach bars, and many outdoor recreation opportunities.

To find out more about this investment opportunity, go here.

Northern Cyprus

With long sandy beaches, ancient history, and possibly the lowest cost of living in the Western World, Northern Cyprus—also known as the Miami of the Mediterranean—is the perfect place to ride out a recession.

It boasts 340 days of sunshine per year and temperatures that rarely rise above 40°C (104°F) or fall below 15°C (59°F), with cooling breezes. Great hospitals and medical care abound.

Northern Cyprus (the Turkish Cypriot side of the island of Cyprus) is not part of the EU. Despite this, business continues as usual on both sides of the border, and residents and vacationers travel freely across the island…

The cost of living in Northern Cyprus starts at US$750 per month for a couple who owns their home. If you rent, monthly living costs start at US$904 for a couple on a shoestring to US$1,354 for those who live large.

A luxury Mediterranean lifestyle could be yours for 27% to 50% of the median cost of a new U.S. mortgage, even before you consider all your other U.S. living costs. Plus, you get strong capital appreciation potential.

I’ve identified a Northern Cyprus resort investment opportunity that offers sea villas and luxury duplex apartments with private rooftop terraces. It will have a wellness center and five-star amenities (restaurants, bars, pools, a spa, and a gym).

Colombia

This country is famous for its rich Latin culture, high standard of living, and safe communities.

You can live here on less than US$500 per month including basic rental costs if you’re on a tight budget, although a middle-class standard of living only costs about US$1,644 per month. If you own your home, your costs will be US$1,161 per month.

To learn more about Colombia’s real estate market, contact our recommended realtor here.

Montenegro

Forbes likens this tiny European country to Monaco, and the world’s billionaires like to hang out here… Overlooking the same stretch of water as Eastern Italy, the ultra-wealthy treat this yachting paradise like their own private riviera.

But while this destination attracts the world’s jetset, it also welcomes people like you and I.

The property I’ve identified is eight minutes from an exclusive marina with waterfront residences, restaurants, luxury shopping, and hotels, and seven minutes from an international airport. Go here to find out more about it.

Con Murphy

Editor, Overseas Property Alert