In last week’s issue, Part I, we looked at how early action turned select opportunities into real equity and income gains for readers who moved quickly.

In this second installment, we continue that review, highlighting more examples where timing and positioning made the difference between seeing an opportunity and making money from it.

These wins are the result of identifying markets early, securing favorable entry points, and staying ahead of price increases as demand catches up. Here’s a closer look at what followed…

Low-Entry Lisbon Apartments—Early Movers Locked In €10K+ Upside

In October, we introduced readers to a rare, early-stage opportunity in Portugal’s most supply-constrained market: Greater Lisbon. The offer was for refurbished, income-focused apartments within commuting distance of the capital.

At the time, pricing started at just €80,000—an unusually low entry point for individually titled units designed for long-term rental in a country facing a severe housing shortage.

That window didn’t stay open for long…

As construction progressed, the developer raised prices. Today, entry begins at €90,000 plus closing costs, giving early movers immediate equity before completion.

The Opportunity Today

The project consists of 28 refurbished apartments, ranging from studios to two-bedroom units. Local companies have already expressed interest in leasing multiple units upon completion, expected in April 2026.

Prices now range from €90,000 to €250,000+, depending on size. To get involved before prices rise again or simply find out more, submit an inquiry by clicking here now.

Northern Cyprus—Where Getting In Early Changed Everything

Northern Cyprus has been one of our most successful long-term calls.

When we first identified it in 2019, it was largely overlooked. Pricing reflected that. Readers who acted early secured positions in developments that have since more than doubled in value, making Northern Cyprus one of the strongest appreciation stories in our track record.

The pattern has been consistent: identify the market early, act before infrastructure and tourism arrive, secure property early, and let the fundamentals do the rest…

Along the north coast, the first wave played out quickly. As residential projects and resort infrastructure came online, prices surged, doubling in under five years.

Then the cycle repeated on the east coast.

When we first recommended beachfront projects in Iskele, the area was still quiet and lightly developed. Hotels, resorts, restaurants, and full-service amenities moved in, followed by tourists from the U.K. and Europe.

Values soared. In 2019, the price per square meter was £845; today, it’s up to £2,600. Readers who acted early are now holding turn-key rentals with appreciation as high as 116%.

It wasn’t luck. It was timing.

The Pattern Repeats: The Last Undeveloped Coastline

Now, the path of progress has reached its final stretch: the west coast—Northern Cyprus’s last undeveloped coastline.

We currently have access to a beachfront resort positioned ahead of the next growth wave, before development and before prices move higher. It’s the same setup we’ve seen twice already, just earlier in the cycle.

This time, it’s backed by stronger-than-ever tourism. In 2024 alone, arrivals rose 18%, increasing pressure on quality beachfront accommodation.

One developer in particular saw this coming and acquired prime beachfront back in 2000, long before today’s momentum. That foresight is now paying off…

This latest project in Northern Cyprus offers private-beach resort living at entry prices that are becoming increasingly scarce. Studios start from £76,500 (about $102,340), with larger units also available. Ocean-view penthouses are priced from £126,500 (about $169,230).

With full management included, projected net rental returns are around 9%, and buyers can enter with 25% down and interest-free payment plans.

Northern Cyprus has already delivered two waves of appreciation. This is the third and likely the last chance to get in before prices reflect a fully developed coastline.

Click here to review availability.

Two More Panama Plays—And The Cost Of Waiting

Over the past year, we introduced readers to two distinct projects from the same developer in Panama—one in the highlands, one on its most desirable stretch of coast.

The first was a luxury alpine-style resort in Boquete, Panama’s most established expat and retiree market. We’ve followed Boquete for more than two decades, but, for years, one thing was missing: new, resort-grade housing that matched demand.

This project changed that. When we first released it, pricing began at $305,765, with fully furnished units and developer financing available. Demand was immediate. Today, Phase I is nearly sold out, with just three units remaining, now priced from $558,250.

As the project advanced, a second phase was released, offering smaller units with a new lower entry point from $218,400. But that window closed quickly as well. Phase II is already nearly sold out, reinforcing the same lesson: in Boquete, well-executed projects don’t linger.

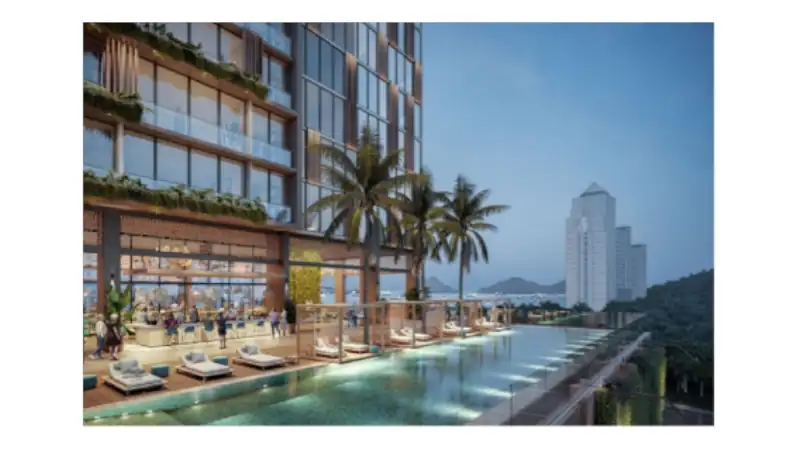

The other Panama opportunity from this developer we launched in January: a branded beachfront resort on Panama City’s most desirable coastline, backed by Westin Residences and Marriott International.

At release, oceanfront units started at $363,000—well below comparable markets like Miami or the Caribbean. Demand followed, and Phase I is now nearly sold out, with no ocean-view units remaining.

Now, Phase II has been released, giving readers another early-mover window, with access ahead of public launch and a limited $40,000 discount.

Once again, the pattern is clear: readers who moved early secured better pricing, selection, and positioning. Those who waited are still seeing strong fundamentals but at higher entry points.

To smooth travels and successful property buys,

Sophia Titley

Editor, Overseas Property Alert